Every business decision involves an investment of resources. Knowing if that investment pays off is crucial for growth. This is where understanding your financial return becomes essential.

A key metric helps you measure this success. It compares the gain from an investment to its original cost. This calculation gives a clear picture of profitability.

This powerful tool is not just for finance experts. Employees use it to justify project proposals. Managers rely on it to assess team performance. Executives apply it to prioritize company initiatives.

Mastering this skill allows any professional to demonstrate measurable business impact. It leads to smarter resource allocation and stronger strategic decisions. This article will guide you through the fundamental concepts and practical applications.

Table of Contents

Key Takeaways

- ROI is a fundamental financial metric for evaluating investment success.

- It measures profitability by comparing gains to the initial cost.

- The result is expressed as a percentage, making comparisons easy.

- This analysis is applicable to various investments, from stocks to marketing campaigns.

- Understanding ROI empowers professionals to make compelling cases for projects.

- It is an essential skill for improving resource allocation and justifying proposals.

- While powerful, it’s important to understand its limitations for fully informed decisions.

Understanding the Basics of ROI

The fundamental question every business faces is whether their expenditures generate sufficient returns. This evaluation forms the cornerstone of financial decision-making across all industries.

Defining ROI in Business and Marketing

Return on investment serves as a crucial ratio that compares financial outcomes to initial costs. It measures profitability by examining the relationship between gains and expenditures.

Businesses use two main approaches: anticipated and actual calculations. Anticipated ROI helps decision-making before projects begin. Actual ROI reflects true performance using final data.

In marketing contexts, a specific formula applies: (Sales increase – Marketing cost) / Marketing cost × 100. This provides clear accountability for campaign spending.

Key Concepts Behind ROI Analysis

A positive result indicates profitable ventures where returns exceed costs. Negative outcomes signal investments that consumed more resources than they generated.

The percentage format enables easy comparison across different investment types and scales. This universal applicability makes it valuable for various contexts.

Accurate calculations require comprehensive cost accounting. Both direct expenses and indirect costs must be included for meaningful results.

This financial tool helps assess everything from stock purchases to marketing campaigns. It determines whether initiatives deliver sufficient value.

The Importance of ROI Analysis in Measuring Investment Performance

Companies constantly face the challenge of determining which opportunities deserve their limited resources. This evaluation process separates successful organizations from those that struggle with growth.

How ROI Shapes Business Decision-Making

This financial metric serves as a critical tool for efficient resource allocation. It helps identify which ventures deliver the greatest return relative to their cost.

Executives rely on this calculation to assess the effectiveness of operational investments and marketing initiatives. Capital flows toward the most productive opportunities when guided by solid financial data.

Calculating potential outcomes before project implementation helps organizations avoid unprofitable ventures. This proactive approach prioritizes initiatives that align with strategic objectives.

The metric enables direct comparison between competing investment options. Decision-makers can objectively evaluate alternatives like different marketing campaigns or technology platforms.

Optimizing this calculation improves overall financial efficiency while guiding strategic planning. It ensures business activities support long-term organizational goals.

Many companies establish performance benchmarks using this financial tool. Setting minimum return requirements creates accountability and focus across the organization.

Regular measurement enables learning from past investments. Organizations can replicate successful strategies and continuously improve resource allocation decisions.

Step-by-Step Guide to Calculating ROI

Translating investment performance into comparable numbers requires specific mathematical approaches. Several standard formulas help professionals calculate roi accurately across different scenarios.

Basic ROI Calculation Formulas and Examples

The most common formula divides the net profit by the total cost investment, then multiplies by 100. This gives the result as a percentage. For instance, a $2,000 profit on a $10,000 investment yields a 20% return.

Another approach compares final and initial investment values. You subtract the starting value from the ending value, divide by the cost investment, and multiply by 100. This method works well for asset appreciation tracking.

Project managers use a adapted calculation: (Financial Value – Project Cost) / Project Cost × 100. This demonstrates the metric’s flexibility across business contexts. Each formula serves different measurement needs while maintaining consistency.

Annualized ROI: Adjusting for Investment Duration

Simple calculation doesn’t account for time, which can misrepresent performance. Annualized ROI standardizes returns to a yearly basis for fair comparison. The formula uses compounding: [(1 + ROI)^(1/n) – 1] × 100%.

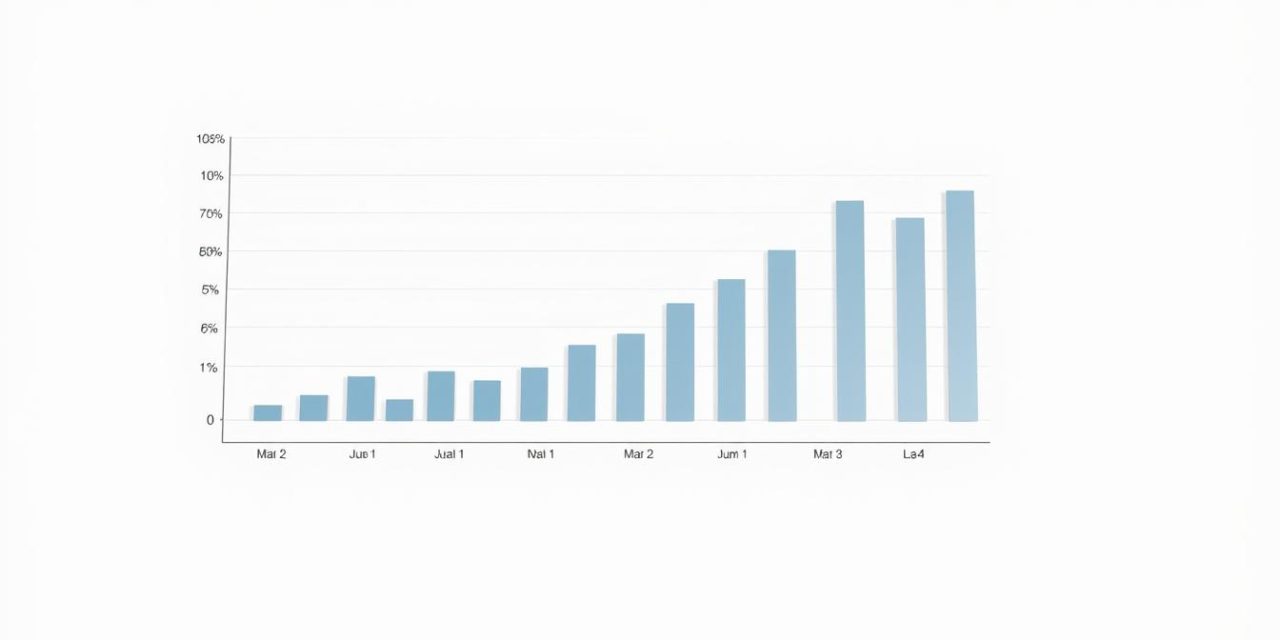

Consider this example: a 50% return over five years equals just 8.45% annualized. Meanwhile, 10% gained in six months annualizes to 21%. This adjustment provides crucial context for evaluating long-term versus short-term investments. Understanding this return on investment calculation helps make smarter financial decisions.

Essential ROI analysis Methods for Evaluating Investment Success

Different investment opportunities often have varying timeframes, making direct comparison difficult. To address this, professionals use specific techniques to standardize performance metrics across different project types.

Comparing Projects and Evaluating Returns

Annualized return on investment is the key method for comparing ventures with different time horizons. It converts all results to an equivalent annual rate.

For example, a 50% gain over five years equals an 8.45% annualized return. A 30% gain over three years equals 9.14% annualized. This shows the second investment actually performed better.

This analysis allows managers to rank competing project proposals objectively. Resources can then be allocated to initiatives promising the highest return.

Leveraging ROI in Marketing and Capital Investments

In marketing, the formula isolates campaign effectiveness. It measures the sales increase minus the campaign cost, divided by the cost.

For major capital expenditures like new equipment, the calculation compares long-term financial benefits against the large upfront cost. This helps justify significant investments.

The same logic applies to technology and human resources. Software investments are evaluated on productivity gains. Training programs are assessed by measuring performance improvements against their cost.

This consistent approach makes return on investment a versatile tool for any business project.

Real-World ROI Calculation Examples

Applying formulas to actual scenarios clarifies their practical power. Seeing numbers in action makes the concept much clearer.

These illustrations show how to account for all factors. They highlight the difference between gross and net figures.

Stock Investment and Dividend Yield Examples

Consider an investor buying 1,000 shares at $10 each. The initial investment is $10,000.

After one year, they sell the shares for $12.50 each. They also earn $500 in dividends but pay $125 in commissions.

The net profit is $2,875. This result gives a 28.75% return. The gains come from a 25% price increase and a 5% dividend yield.

Commission costs reduced the final figure by 1.25%. This example shows why tracking all expenses is vital.

Real Estate and Project-Based ROI Calculations

A simple business example involves selling chocolate bars. Buying 1,000 bars for $2,000 and selling them for $3,000 seems profitable.

But you must include the $100 transport costs. Total expenses become $2,100.

The net profit is $900. This leads to a 42.9% return on the investment.

If you sell for less, the result changes dramatically. This shows how sensitive the ROI is to final income.

Real estate calculations are even more complex. They must include mortgage interest, taxes, and maintenance over the period.

Overcoming Common Pitfalls in ROI Calculations

Accurate financial evaluation requires awareness of common calculation errors. Many professionals rely on basic formulas without understanding their significant limitations. These weaknesses can lead to poor investment decisions.

The standard calculation fails to account for investment duration. Comparing a 25% return investment over five years with a 15% gain in one year is misleading. Time becomes a critical factor in true profitability investment assessment.

Addressing Unequal Cash Flow Challenges

Another major limitation involves risk adjustment. Higher potential returns typically involve greater risk exposure. Small-cap stocks often show better results but carry substantially more volatility.

Cost omissions can also inflate figures. When relevant costs are excluded, the final roi becomes misleading. This leads to overestimated profitability.

| Investment Type | Total Return | Time Period | Annualized Return |

|---|---|---|---|

| Investment X | 25% | 5 years | 4.6% |

| Investment Y | 15% | 1 year | 15.0% |

| Equal Cash Flows | $25,000 | 5 years | 5.00% IRR |

| Front-Loaded Flows | $25,000 | 5 years | 8.64% IRR |

Uneven cash distributions present another challenge. Projects with early returns provide reinvestment opportunities. The timing of income significantly impacts overall value.

Understanding these limitations helps investors make better decisions. Combining metrics provides a more complete financial picture.

Practical Strategies to Optimize ROI and Boost Profitability

Achieving strong financial outcomes requires more than just calculating numbers; it demands strategic optimization of the entire investment process. The true value of this metric comes from using it to guide smarter decisions and improve future performance.

Best Practices for Accurate Data Collection

The foundation of a reliable roi is high-quality data. Companies must capture all relevant costs, including indirect expenses like opportunity costs. Using historical data from similar projects provides a realistic benchmark.

For a new service launch, this means tracking development costs, marketing spend, and time-to-market. This comprehensive approach ensures accuracy and paints a complete picture of the investment’s true value.

Utilizing Financial Tools and Techniques

Selecting the right calculation method for each project type is crucial. The time period for evaluation must be long enough to show meaningful results but short enough to link performance directly to the investment.

Statistical techniques can identify trends in past data, improving the accuracy of future projections. This continuous refinement of methods helps organizations allocate resources more effectively toward their goals.

Integrating ROI with Other Key Financial Metrics

While powerful, roi should not be used in isolation. Combining it with metrics like payback period or internal rate of return provides a fuller view of an investment’s benefit.

This integrated approach is vital for complex ventures like international expansion, where upfront costs are high. A multi-metric strategy leads to superior profitability and long-term success.

Combining Leverage with ROI for Enhanced Investment Results

Using borrowed funds to increase investment size creates opportunities for multiplied gains but also heightened risks. Leverage allows investors to control larger positions with less personal capital. This strategy can dramatically boost returns when investments perform well.

Analyzing the Impact of Leverage on Net Returns

Consider purchasing 1,000 shares at $10 each using 50% margin. You invest $5,000 personal capital and borrow $5,000. When shares rise to $12.50, your return jumps from 28.75% to 48.5%.

This calculation must include all costs. Margin interest reduces net profit even as leverage amplifies percentage returns. The same investment shows leverage’s double-edged nature.

If shares fall to $8, the loss becomes -41.5% instead of -16.25%. Leverage magnifies both gains and losses equally. This requires careful risk assessment before using borrowed money.

Strategic leverage makes sense for high-confidence projects with strong anticipated returns. Always calculate both leveraged and unleveraged scenarios during planning. Different financing options carry varying interest rates that impact final outcomes.

Conclusion

The ability to quantify investment performance separates strategic thinkers from reactive decision-makers in today’s competitive business landscape. Return on investment serves as a fundamental metric that compares gains against costs, providing clear insight into profitability across various ventures.

While this calculation offers intuitive clarity, professionals must acknowledge its limitations, particularly regarding time periods and risk factors. Effective evaluation requires comprehensive cost accounting and appropriate methods tailored to specific business scenarios.

Mastering this skill empowers organizations to allocate resources efficiently, compare alternatives objectively, and align initiatives with strategic goals. For deeper insights into optimizing your financial return on investment calculations, explore our comprehensive guide.

When applied consistently, this approach transforms financial evaluation from a reactive exercise into a proactive strategy for sustainable growth and improved organizational performance.

FAQ

What is the main purpose of calculating return on investment?

The main purpose is to measure the profitability of an investment. It helps businesses understand how much profit was generated relative to the cost. This figure is crucial for comparing the performance of different projects and making informed decisions about where to allocate capital.

How do I calculate the basic return on investment formula?

The basic formula is: (Net Gain from Investment – Cost of Investment) / Cost of Investment. You then multiply the result by 100 to get a percentage. This percentage shows the profit or loss compared to the initial amount spent.

Why is it important to annualize the return on investment?

Annualizing the result adjusts for the time period of the investment. This allows for a fair comparison between projects that have different durations. It standardizes the metric to an annual rate, making it easier to evaluate long-term performance against other opportunities.

What are some common challenges when evaluating investment performance?

A common challenge is dealing with unequal cash flows over time. Other issues include accurately accounting for all expenses and ensuring data accuracy. Failing to include hidden costs can significantly distort the final profit figure and lead to poor business decisions.

How can a company improve its overall profitability?

Companies can boost profitability by meticulously tracking all costs and income related to a project. Utilizing financial tools for data collection and integrating the profit metric with other key performance indicators, like net present value, provides a more complete picture of value and risk.

What role does leverage play in affecting net returns?

Leverage, or using borrowed capital, can amplify net returns if the investment performs well. However, it also increases the potential risk. If the project’s gains are lower than expected, leverage can magnify losses, making the net result less favorable.