As an independent professional in France, you’re likely aware of the significant changes on the horizon for invoicing requirements. The upcoming e-invoicing mandate is set to transform how business transactions are documented and reported, impacting your daily operations.

The shift towards electronic facturation may seem daunting, but with the right guidance, you can navigate this change with confidence. Our comprehensive guide will walk you through the evolving landscape of invoicing solutions in France, from understanding regulatory requirements to implementing efficient systems that meet your business needs.

We’ll explore the transition timeline, beginning in 2024, and provide actionable strategies to streamline your factures processes, reduce administrative burden, and ensure compliance with French tax authorities.

Table of Contents

Key Takeaways

- Understand the upcoming e-invoicing mandate and its impact on your business

- Learn how to select the right logiciel for your invoicing needs

- Discover strategies to streamline your invoicing processes

- Ensure compliance with French tax authorities

- Navigate the transition to electronic facturation with confidence

The Evolving Landscape of Invoicing in France

France’s shift towards digitalization is transforming the invoicing processes for independent professionals, enhancing efficiency and compliance. As the country moves towards mandatory digital invoicing, professionals must adapt to new regulations and technologies.

Current Invoicing Requirements for Independent Professionals

Currently, independent professionals in France are required to maintain accurate records of their transactions. The facturation process involves creating invoices that comply with French regulations, including mandatory details such as company information, client details, and a clear description of services rendered.

Key Challenges Faced by Freelancers and Small Businesses

Freelancers and small businesses often encounter several challenges in their invoicing processus, including:

- Managing inconsistent invoicing processes that lead to delays in payment and cash flow issues.

- Manual invoice creation, which is time-consuming and prone to erreurs.

- Tracking unpaid invoices and following up with clients, which requires significant administrative effort.

- Lack of technical infrastructure to transition smoothly to electronic invoicing systems.

- Staying compliant with evolving tax regulations, a task that can be daunting without dedicated accounting support.

As stated by a French business expert, « L’ensemble des entreprises françaises auront évolué vers la dématérialisation obligatoire de leurs factures. Ces fonctionnalités augmentent vos performances et vous font gagner un temps précieux. » This highlights the importance of adapting to the changing invoicing landscape to save time and enhance performance.

Understanding E-Invoicing Regulations in France

The French government’s push for digitalization includes significant reforms in e-invoicing, affecting how independent professionals conduct business. E-invoicing, or electronic invoicing, is becoming a standard practice in France, particularly for B2B transactions.

The 2024-2026 E-Invoicing Reform Timeline

The French government has outlined a clear timeline for the implementation of e-invoicing reforms from 2024 to 2026. This timeline is crucial for independent professionals to understand and prepare for the changes ahead.

Key milestones include the gradual introduction of e-invoicing requirements, starting with larger enterprises and eventually covering smaller businesses and independent professionals.

Difference Between E-Invoicing and E-Reporting

E-invoicing and e-reporting are two related but distinct concepts under the French e-invoicing regulations. E-invoicing applies exclusively to domestic B2B transactions between French companies, requiring structured electronic invoices transmitted through certified platforms.

E-reporting, on the other hand, covers transactions not subject to e-invoicing, such as B2C sales and international transactions. It requires businesses to report key transaction data to tax authorities without necessitating a formal electronic invoice.

- The French reform introduces two distinct but related obligations: e-invoicing and e-reporting.

- E-invoicing applies to domestic B2B transactions, while e-reporting covers B2C and international transactions.

- Understanding the distinction is crucial for independent professionals working with both businesses and consumers.

Essential Components of a Compliant French Invoice

As France moves towards a more digital invoicing system, understanding the essential components of a compliant invoice is crucial for independent professionals. A compliant invoice ensures that you are meeting the regulatory requirements, thereby avoiding potential issues.

Mandatory Information for Standard Invoices

For a standard invoice to be compliant, it must include specific mandatory information. This includes the invoice number, date, and details of the supplier and customer. The invoice must clearly state the goods or services provided, along with their corresponding prices and VAT rates. Ensuring that your invoices contain this information is vital for maintaining compliance.

Additional Requirements for Electronic Invoices

Electronic invoices, or factures électroniques, have additional requirements beyond those for standard invoices. They must be in a structured format, such as UBL or CII, to allow for automated processing. The use of the Factur-X hybrid format, which combines a human-readable PDF with embedded XML data, is becoming increasingly common in France. Ensuring the dématérialisation process is secure and compliant is crucial.

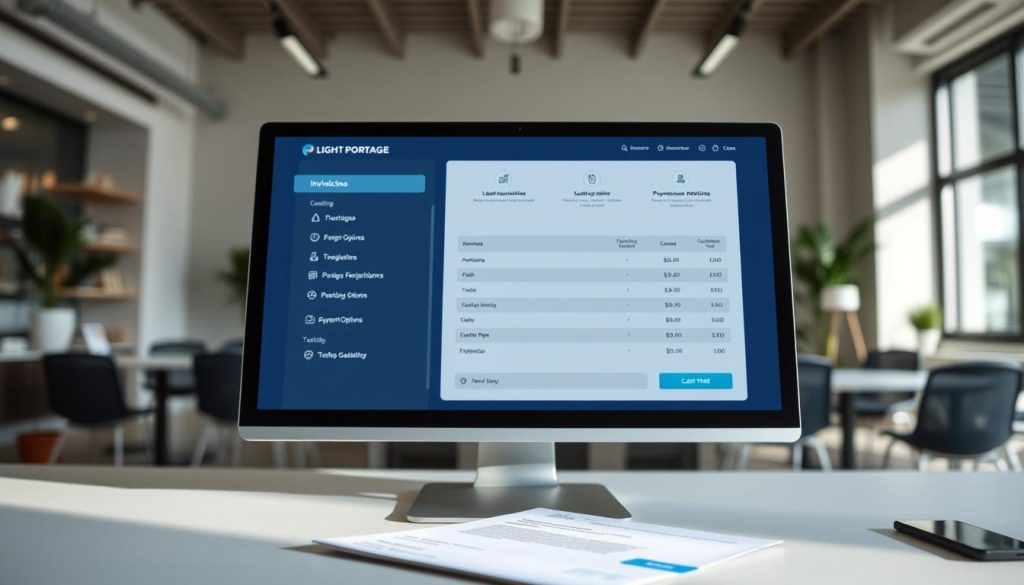

Digital Invoicing Solutions for Independent Professionals

For independent professionals in France, adopting digital invoicing solutions is a strategic move towards enhancing their financial administration and reducing administrative burdens. Digital invoicing streamlines financial management, making it easier to track invoices and payments.

Cloud-Based Invoicing Platforms

Cloud-based invoicing platforms offer flexibility and accessibility, allowing you to manage your invoices from anywhere. These platforms often include features such as automated reminders and real-time tracking, enhancing your facturation process.

Integrated Accounting and Invoicing Systems

Integrated systems combine invoicing functionality with broader accounting capabilities, creating a seamless financial management experience. By using a comprehensive logiciel that includes invoicing and accounting, you can automatically record invoices in your accounting ledgers, eliminating duplicate data entry and reducing errors. This integration ensures that your financial données remain accurate and up-to-date.

By leveraging a logiciel facture that is designed for independent professionals, you can simplify your financial management and focus on growing your business.

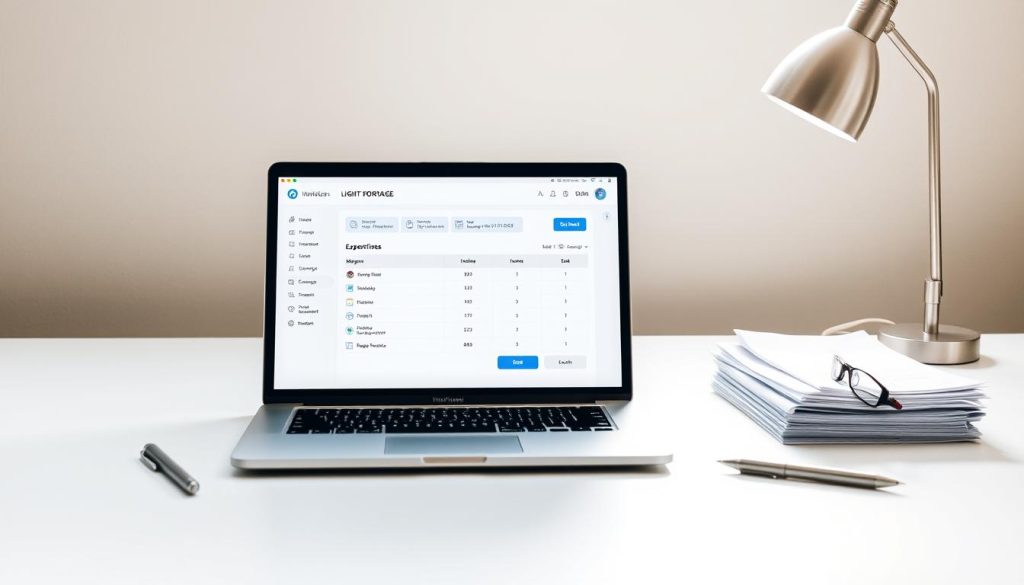

Selecting the Right Invoicing Software

Selecting an appropriate invoicing solution is vital for the financial health of independent professionals operating in France. The right logiciel de facturation can streamline financial management, reduce errors, and improve cash flow.

Key Features to Look For

When evaluating invoicing software, consider the essential features that meet your business needs. Key aspects include user-friendly interfaces, customizable invoice templates, automated payment reminders, and integration with existing accounting systems. It’s also crucial to ensure compliance with French invoicing regulations, such as the ability to generate invoices that meet the required standards for facturation.

Pricing Considerations for Independent Professionals

Entreprises should carefully assess the pricing models of various invoicing solutions. Pricing can vary significantly, from free basic plans to tiered subscription services based on features or invoice volume. Consider the return on investment by evaluating time saved, improved cash flow, and reduced risk of non-compliance. Many solutions offer free trials; take advantage of these to test functionality before committing. A comparison of pricing models is provided in the table below:

| Pricing Model | Features | Cost |

|---|---|---|

| Basic | Limited features, suitable for small businesses | Free |

| Premium | Advanced features, customizable templates | €20/month |

| Enterprise | Comprehensive features, dedicated support | €50/month |

Implementing Piste d’Audit Fiable (PAF) for Your Invoicing

The implementation of Piste d’Audit Fiable (PAF) for invoicing is a critical step for independent professionals to ensure transparency and compliance with French regulations. A reliable audit trail is essential for maintaining accurate records and demonstrating adherence to legal requirements.

Requirements for a Reliable Audit Trail

A reliable audit trail must include comprehensive details about all invoicing activities. This encompasses accurate timestamps for the creation, transmission, and any status changes of invoices.

Documentation and Record-Keeping Best Practices

To maintain a compliant PAF, independent professionals should adhere to the following best practices:

- Establish a clear documentation policy that outlines your invoicing process, including who is authorized to create and approve invoices.

- Maintain systematic records of all invoices issued and received, including timestamps for creation, transmission, and any status changes.

- Implement version control for invoice templates and numbering systems to prevent unauthorized modifications or duplicate invoice numbers.

- Store supporting documentation that validates the underlying transaction, such as contracts, purchase orders, and delivery confirmations.

- Ensure your archiving system meets the French requirement to store invoices for at least 10 years in a format that preserves their integrity and readability.

By implementing these practices, independent professionals can ensure their invoicing processes are compliant with PAF requirements, reducing the risk of non-compliance and associated penalties.

Streamlining Your Invoicing Process

For independent professionals in France, optimizing the invoicing process can significantly reduce administrative burdens and improve financial stability. Streamlining invoicing involves adopting strategies that minimize erreurs (errors) and enhance the overall efficiency of the billing process.

Automation Strategies for Recurring Invoices

Implementing automation for recurring invoices can save time and reduce the likelihood of erreurs. By setting up a system that automatically generates and sends invoices, independent professionals can ensure timely payments and maintain a consistent cash flow.

Managing Client Payment Terms Effectively

Clearly defining and communicating payment terms from the outset is crucial. Consider offering multiple payment methods and implementing a systematic follow-up for overdue payments. Utilizing temps réel (real-time) payment tracking can also help in managing client payments effectively, ensuring that invoices are paid promptly and reducing the need for manual follow-ups related to facture status.

Connecting with Platforms de Dématérialisation Partenaires (PDP)

As France moves towards mandatory e-invoicing, understanding the role of Platforms de Dématérialisation Partenaires (PDP) is crucial. PDPs will act as intermediaries between businesses and the tax authorities, facilitating the transmission of electronic invoices.

Public Portal vs. Private Platforms

The new e-invoicing regulations will offer businesses the option to use either a public portal or private plateformes for invoice transmission. While the public portal provides a straightforward solution, private platforms may offer more flexibility and additional features tailored to specific business needs.

Integration with Your Existing Systems

To ensure seamless transmission of electronic invoices, integrating your logiciel facture with a PDP will be necessary. Different integration methods will be available, including direct API connections and file transfers. Many logiciels vendors are developing built-in connections to PDPs, simplifying the integration process. Consider working with a dématérialisation operator (OD) if you need assistance with integration, as they specialize in connecting businesses with PDPs.

Tax Implications and Reporting Requirements

As independent professionals in France navigate the evolving landscape of invoicing, it’s crucial to understand the tax implications and reporting requirements. The introduction of e-invoicing is set to digitalize the treatment of commercial data, thereby simplifying the sharing of données across platforms.

VAT Considerations for Independent Professionals

For independent professionals, understanding VAT considerations is paramount. E-invoicing systems generate structured data that can be used to automate and simplify tax declaration processes. By properly categorizing transactions in your facturation system, you can generate reports that align with tax declaration requirements.

Leveraging Invoicing Data for Tax Declarations

Leveraging invoicing data for tax declarations can significantly reduce manual compilation work. Regular reconciliation between your facture data and accounting records ensures consistency in tax reporting and minimizes discrepancies that could trigger audits. As toutes entreprises adapt to e-invoicing, maintaining accurate and consistent invoicing practices becomes increasingly important.

« L’e-invoicing devrait donc avoir pour effet d’accélérer le traitement des données commerciales en digitalisant l’ensemble des processus, » which translates to a more streamlined and efficient process for toutes entreprises.

Conclusion: Future-Proofing Your Invoicing Practices

With e-invoicing on the horizon, French independent professionals must prepare for a more streamlined financial future.

Embracing facturation électronique now brings efficiency advantages and readies you for the mandatory factures électroniques. The future involves greater automation and real-time financial visibility.

FAQ

What is e-invoicing, and how does it affect my business as an independent professional in France?

E-invoicing, or electronic invoicing, is the process of sending invoices electronically to clients and, in some cases, to the tax administration. As an independent professional in France, you will be required to adopt e-invoicing as part of the 2024-2026 e-invoicing reform. This change aims to simplify invoicing and improve tax compliance.

What are the key components of a compliant French invoice, and how do I ensure my invoices meet these requirements?

A compliant French invoice must include specific mandatory information, such as your business details, client information, and a clear description of the services provided. For electronic invoices, additional requirements apply, including a unique identifier and a timestamp. You can ensure compliance by using invoicing software that is designed for the French market and adheres to the latest regulations.

How do I choose the right invoicing software for my needs as an independent professional?

When selecting invoicing software, consider key features such as ease of use, integration with your existing accounting systems, and compliance with French e-invoicing regulations. You should also evaluate pricing models to ensure they align with your business needs and budget. Look for software that offers automation capabilities, reliable audit trails, and good customer support.

What is Piste d’Audit Fiable (PAF), and how do I implement it for my invoicing?

Piste d’Audit Fiable (PAF), or a reliable audit trail, is a requirement for businesses in France to maintain detailed records of their invoicing and accounting processes. To implement PAF, you need to ensure that your invoicing system can track and record all transactions, including any changes or cancellations, in a secure and tamper-proof manner. This involves selecting invoicing software that supports PAF and following best practices for documentation and record-keeping.

How can I streamline my invoicing process to save time and reduce errors?

Streamlining your invoicing process can be achieved through automation strategies, such as setting up recurring invoices for regular clients and using templates for standard invoices. Additionally, managing client payment terms effectively by clearly communicating your expectations and offering convenient payment options can help reduce delays and disputes.

What are the tax implications of e-invoicing for independent professionals in France, particularly regarding VAT?

E-invoicing will simplify VAT reporting and compliance for independent professionals in France. You will need to ensure that your invoicing system is capable of accurately calculating and reporting VAT. Leveraging your invoicing data for tax declarations will become more straightforward, reducing the administrative burden associated with tax compliance.

What is the difference between e-invoicing and e-reporting, and how do they relate to the French tax administration?

E-invoicing refers to the electronic exchange of invoices between businesses and their clients, while e-reporting involves submitting invoicing data to the tax administration. In France, e-invoicing will be implemented in conjunction with e-reporting, requiring businesses to send certain invoicing data to the tax authorities. This will enhance tax compliance and simplify the reporting process.