Are you tired of waiting for payments from clients?

You’re not alone. Seventy-four percent of freelancers report not being paid on time. This can be a significant challenge for those who rely on timely compensation to maintain their cash flow and grow their business.

Choosing the right payment methods is crucial for freelancers to get paid promptly and fully for their work. By understanding your options and carefully selecting the best payment solutions for your business, you can minimize fees and ensure a smooth financial transaction with your clients.

Table of Contents

Key Takeaways

- Understand the importance of choosing the right payment methods for your freelance business.

- Learn about various secure and reliable payment options available to freelancers.

- Discover strategies for protecting your earnings and establishing professional payment terms with clients.

- Identify the most efficient payment solutions for your unique business needs.

- Minimize fees and ensure timely compensation for your work.

Understanding Freelance Payment Methods

The choice of payment method can significantly impact a freelancer’s cash flow and overall business operation. By understanding and carefully selecting your payment options, you’re putting key structures in place to ensure you are compensated promptly and fully for your work.

What Are Freelance Payment Methods?

Freelance payment methods refer to the various ways in which independent professionals receive payments from their clients. These methods can range from traditional bank transfers and paper checks to digital payment platforms and online marketplaces. Reliable payment methods are essential for freelancers to manage their finances effectively and maintain a stable cash flow.

Why Payment Methods Matter for Freelancers

Payment methods matter significantly for freelancers as they directly impact their financial security and peace of mind. Different payment methods offer varying levels of protection against non-payment, disputes, and fraud. For instance, some payment methods provide features like automated invoicing, payment tracking, and accounting integration, which can significantly reduce administrative burden.

The right payment method can also enhance a freelancer’s credibility and reputation, signaling to clients that they’re working with an established business rather than a hobbyist. As freelancers scale their businesses and take on more clients, having efficient payment methods becomes increasingly important for managing multiple revenue streams.

| Payment Method | Security Features | Convenience Level |

|---|---|---|

| Bank Transfers | High | Medium |

| Digital Payment Platforms | High | High |

| Paper Checks | Low | Low |

By choosing the right payment method, freelancers can ensure timely compensation, reduce administrative tasks, and focus on growing their business. It’s essential to consider factors like security, convenience, and cost when selecting a payment method.

Traditional Payment Methods for Freelancers

Despite the rise of digital payments, traditional methods such as bank transfers, paper checks, and cash payments are still in use among freelancers. These methods have their own set of advantages and disadvantages, making them suitable for different types of freelance work and client relationships.

Bank Transfers

Bank transfers are a common traditional payment method for freelancers, especially for international clients. To set up an international bank transfer, freelancers need to provide their bank details, including the SWIFT code, IBAN number, and account name, to their clients.

This method is secure and reliable, but it may involve fees from both the sender’s and recipient’s banks. Understanding the fees and exchange rates is crucial to avoid unexpected deductions.

Paper Checks

While not as common in the digital age, some clients still prefer to pay freelancers with paper checks. For instance, a freelance writer working with a major publisher might receive a check as payment. The publisher’s finance department may prefer this method due to their established accounting procedures.

Freelancers receiving checks need to deposit them into their bank accounts, which may involve waiting periods for the check to clear.

Cash Payments

Cash payments are primarily relevant for freelancers providing in-person services to local clients, such as photographers, tutors, or event professionals. The immediate availability of funds is a significant advantage, with no waiting periods for processing or clearing.

- Cash transactions eliminate third-party processing fees.

- However, they present significant security risks, including potential theft or loss.

- Freelancers accepting cash should maintain accurate records for tax purposes.

As businesses increasingly move toward digital operations, cash payments are becoming less common in the freelance ecosystem, though they remain relevant in certain niches.

Digital Payment Platforms

The rise of digital payment platforms has revolutionized the way freelancers receive payments, offering convenience, security, and efficiency. These platforms have become indispensable for freelancers looking to manage their finances effectively in a global marketplace.

PayPal

PayPal is one of the most widely recognized digital payment platforms among freelancers. It offers a straightforward way to send and receive payments online.

With its widespread acceptance and ease of use, PayPal is a popular choice for freelancers. However, it’s essential to consider its fees and terms when deciding if it’s the right option for your business.

Wise Business

Wise Business is particularly beneficial for international freelancers, offering a cost-effective solution for cross-border transactions. It provides transparent exchange rates and lower fees compared to traditional banking services.

Wise Business is designed to help freelancers manage their international transactions efficiently, making it an attractive option for those working with global clients.

Stripe

Stripe is a comprehensive payment platform that caters to businesses of all sizes, including freelancers. It offers sophisticated payment infrastructure, allowing for the acceptance of credit card payments and other methods directly through custom invoices or websites.

Stripe’s features include recurring billing, support for 135+ currencies, and localized payment methods, making it a versatile solution for freelancers with diverse client bases. Its robust security features and detailed reporting tools further enhance its appeal to established freelance businesses.

Freelance Marketplace Payment Systems

Freelance marketplaces have developed unique payment systems to facilitate transactions between clients and freelancers. These systems are designed to provide a secure and efficient way for freelancers to receive payments for their work.

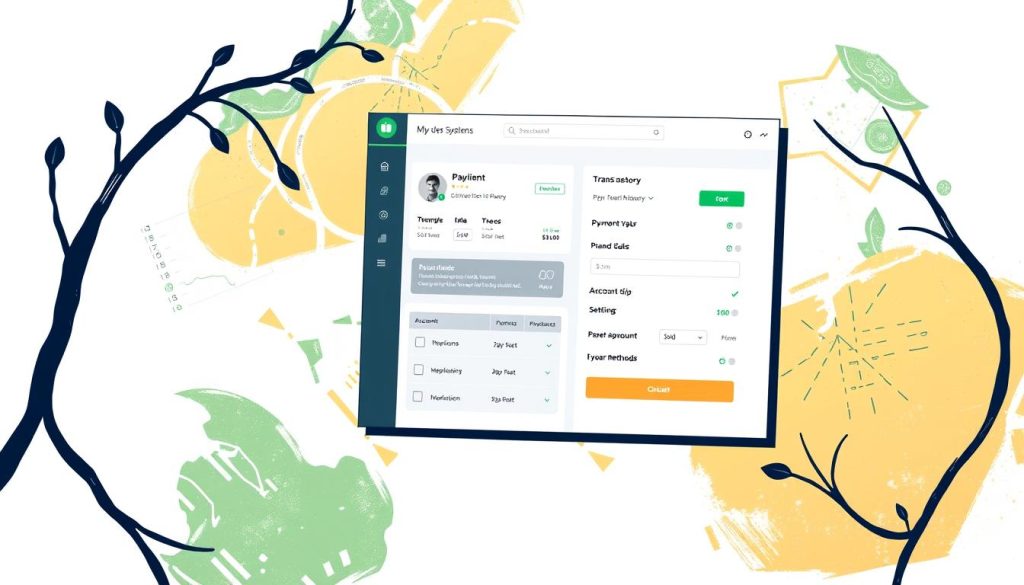

Upwork Payment System

Upwork offers a variety of payment options for freelancers, including direct deposit, PayPal, and wire transfer. The platform holds payments in escrow until the client confirms satisfactory completion of the work, ensuring that freelancers get paid for their efforts. According to Upwork’s policies, freelancers can choose their preferred payment method, making it convenient to receive payments.

Fiverr Payment System

Fiverr’s payment system is designed to protect both buyers and sellers. Clients pay upfront, and the funds are held until the client confirms that the work is up to standard. Fiverr keeps 20% of the funds from each sale, including tips. Top sellers enjoy a 7-day clearing period, while regular sellers wait 14 days.

Other Marketplace Options

Beyond Upwork and Fiverr, freelancers can access numerous specialized marketplaces with their own payment systems, such as Toptal for premium tech talent, 99designs for graphic designers, and Contently for content. These niche marketplaces often offer payment structures tailored to specific industries, with some providing higher rates and lower commission fees than general freelance platforms.

Freelancers should consider the payment threshold requirements and fees associated with different marketplaces when choosing where to work. By understanding the payment systems used by various marketplaces, freelancers can make informed decisions about their careers and manage their finances effectively.

Specialized Freelance Payment Methods

Beyond traditional payment methods, freelancers can now leverage specialized payment options tailored to their unique needs. These methods offer enhanced convenience and flexibility, catering to the diverse requirements of independent professionals.

Payoneer

Payoneer is a popular choice among freelancers due to its ability to facilitate international transactions with ease. It offers a range of services, including a digital payment platform that enables freelancers to receive payments from clients worldwide.

Cryptocurrency Payments

Cryptocurrencies like Bitcoin have emerged as a viable payment method for freelancers seeking low-cost and quick international transactions. One of the key benefits is the lower transaction fees compared to traditional banking and online payment services. Cryptocurrency transactions are often faster, providing freelancers with quicker access to their funds.

Mobile Payment Apps

Mobile payment apps such as Venmo, Cash App, and Zelle have gained popularity among freelancers for domestic transactions due to their convenience, instant transfers, and widespread adoption. These apps typically offer free or low-cost transfers between users, making them cost-effective payment methods for smaller transactions or recurring payments from established clients.

In conclusion, specialized freelance payment methods are revolutionizing the way freelancers receive payments. By offering enhanced convenience, security, and efficiency, these methods are set to play a crucial role in the future of freelance work.

Security Considerations for Freelance Payment Methods

As a freelancer, ensuring the security of your payment methods is crucial in today’s digital landscape. With the rise of digital transactions, protecting your financial information has become a top priority.

Protecting Your Financial Information

To safeguard your financial information, it’s essential to be cautious when dealing with clients. Verifying a client’s identity and legitimacy before starting work can significantly reduce the risk of fraud. This can be done by researching potential clients online, requesting references, and considering smaller initial projects to build trust. Additionally, using escrow services or milestone-based payments for new client relationships provides an added layer of security by ensuring that funds are verified before work commences.

Avoiding Payment Scams and Fraud

Freelancers must be vigilant to avoid payment scams and fraud. Be wary of clients who request unusual payment arrangements, such as returning a portion of a payment or processing funds on their behalf. It’s also crucial to be alert to phishing attempts that mimic legitimate payment platforms. Always verify email addresses and access accounts directly through official websites rather than email links. Creating detailed contracts that specify payment terms, methods, and schedules can help prevent misunderstandings and provide necessary documentation in case of disputes.

By understanding the chargeback and dispute resolution policies of different payment methods, freelancers can select platforms that offer appropriate protection for their type of work. Being cautious of clients who rush projects or pressure for immediate work before payment details are finalized can also help avoid scam situations. Maintaining records of all communications, work delivered, and payment transactions provides evidence that can be crucial if payment issues arise.

Choosing the Right Payment Method for Your Freelance Business

Freelancers must carefully consider various payment options to find the one that best suits their business needs. The ideal payment method strikes a balance between convenience for both parties, reasonable fees, and robust security features.

Factors to Consider When Selecting Payment Methods

When evaluating payment methods, consider factors such as fees associated with transactions, the ease of use for both you and your clients, and the level of security provided. It’s essential to calculate the true cost of each payment method, including direct fees, currency conversion losses, and potential cash flow impacts.

- Evaluate how different payment methods affect your professional image.

- Consider offering multiple payment options to accommodate different client preferences.

Payment Methods for International Clients

If you work with international clients, using a payment processor like Stripe can simplify your payments setup. Stripe supports transactions in multiple currencies and payment methods, ensuring you don’t lose out on international clients due to payment method limitations.

| Payment Method | Fees | Security Features |

|---|---|---|

| Stripe | Competitive transaction fees | Advanced security measures |

| PayPal | Transaction fees apply | Buyer and seller protection |

| Bank Transfers | Variable fees | Secure, direct bank-to-bank transfer |

Balancing Convenience, Cost, and Security

To find the optimal payment method, you need to balance convenience, cost, and security. Consider creating a tiered approach where preferred payment methods are standard, but alternative options are available for specific client situations. Regularly review and reassess your payment methods as your business evolves.

By implementing clear payment policies in your contracts and client onboarding materials, you can set expectations and guide clients toward your preferred payment methods. Remember, the cheapest payment method isn’t always the best choice if it creates friction in the client relationship or requires significant time to manage.

Conclusion

The choice of payment method is a critical decision for freelancers, impacting their cash flow and client relationships. To optimize financial operations, it’s essential to select a combination of payment methods that cater to different client types and project structures.

Regularly reviewing and updating your payment methods ensures you’re leveraging new technologies and competitive fee structures. Clear communication with clients about payment terms and schedules remains vital. By investing time in understanding and optimizing your payment processes, you can significantly improve your freelance business’s efficiency and profitability.

Ultimately, the best payment methods are those that seamlessly integrate into your business, reliably delivering your earnings while minimizing management efforts. This allows you to focus on delivering exceptional work to your clients, ensuring a stable and profitable freelance career.

FAQ

What are the most secure payment platforms for receiving international payments?

Platforms like PayPal, Wise Business, and Stripe are considered secure options for receiving international payments due to their robust security features and compliance with financial regulations.

How do transaction fees vary across different payment systems?

Transaction fees can vary significantly across different payment systems. For instance, bank transfers may have lower fees for domestic transactions but higher fees for international transactions. Digital platforms like PayPal and Stripe charge a percentage of the transaction amount plus a fixed fee per transaction.

What are the benefits of using an escrow service for client payments?

Using an escrow service can provide a layer of security for both freelancers and clients. It holds the client’s payment until the work is completed to their satisfaction, reducing the risk of non-payment or disputes.

Can I receive payments in multiple currencies, and how does currency conversion work?

Yes, many digital payment platforms and specialized services like Payoneer allow you to receive payments in multiple currencies. The conversion rates are typically based on the current market rate, with some platforms charging a conversion fee.

How can I protect my financial information when receiving payments online?

To protect your financial information, it’s essential to use reputable and secure payment platforms that comply with financial security standards. Additionally, being cautious with sensitive information and monitoring your accounts regularly can help prevent fraud.

What are the advantages of using cryptocurrency for freelance payments?

Cryptocurrency payments can offer advantages such as lower transaction fees, faster settlement times, and a level of anonymity. However, they also come with volatility risks and require both parties to be comfortable with the technology.

How do I choose the best payment method for my freelance business?

Choosing the best payment method involves considering factors such as the type of clients you work with, the currencies you need to transact in, the fees associated with different payment options, and the level of security and convenience required.