In a groundbreaking move that signals the growing mainstream adoption of cryptocurrency in corporate finance, Umalis Group has announced an innovative Bitcoin payroll allocation strategy. As France’s only publicly listed wage portage company, Umalis Group is setting new standards for financial innovation while enhancing value for its consultants. This strategic initiative combines forward-thinking asset management with tangible benefits for the company’s workforce, positioning Umalis Group at the forefront of digital asset integration in the payroll sector.

Table of Contents

Umalis Group: France’s Pioneer in Wage Portage Innovation

Umalis Group headquarters – The only publicly listed wage portage company in France pioneering Bitcoin payroll allocation

Founded in 2008, Umalis Group (Euronext Access – FR0011776889 – MLUMG) has established itself as a leading player in the French wage portage market. As the only publicly listed company in this sector, Umalis Group has built a reputation for innovation and excellence in payroll outsourcing services. Over its 15-year history, the company has supported thousands of consultants, primarily in engineering and digital professions, generating a cumulative business volume exceeding €140 million.

Wage portage, a unique employment model popular in France, allows independent professionals to access the benefits of salaried employment while maintaining their autonomy. Umalis Group serves as an intermediary, handling administrative, legal, and payroll responsibilities for these consultants, enabling them to focus on their core expertise while enjoying enhanced financial security.

This established market position provides Umalis Group with the stability and expertise to pioneer innovative financial approaches like their Bitcoin payroll allocation strategy, further differentiating them in the competitive wage portage landscape.

The Strategic Announcement: Bitcoin Integration in Payroll Management

Umalis Group’s strategic allocation of 3% of monthly payroll to Bitcoin

On December 8, 2025, Umalis Group announced the implementation of a strategic financial scheme involving the allocation of part of its payroll into Bitcoin (BTC). This initiative forms part of a long-term policy combining innovation, consultant protection, and strengthened financial guarantees.

Under this forward-thinking strategy, Umalis Group plans to allocate 3% of its monthly payroll to a secure Bitcoin wallet. This measured approach allows the company to explore cryptocurrency’s potential benefits while maintaining responsible financial management and limiting exposure to market volatility.

The announcement represents a significant step in corporate cryptocurrency adoption, particularly in the traditionally conservative payroll sector. By implementing this strategy, Umalis Group positions itself as a pioneer in financial innovation within the wage portage industry.

Robust Security Measures: Prioritizing Asset Protection

Secure Bitcoin wallet operated under strict regulatory oversight for Umalis Group’s allocation strategy

Understanding the importance of security in cryptocurrency management, Umalis Group has implemented robust protective measures for its Bitcoin allocation strategy. The company’s Bitcoin wallet will be operated by a banking institution that holds all necessary authorizations from France’s key financial regulatory bodies:

- Authorization from the French Financial Markets Authority (Autorité des Marchés Financiers – AMF)

- Approval from the Prudential Supervision and Resolution Authority (Autorité de Contrôle Prudentiel et de Résolution – ACPR)

This partnership with a regulated banking institution ensures that Umalis Group’s Bitcoin allocation operates within a strictly regulated and secure framework. The company has prioritized security and compliance at every stage of implementation, creating a model that balances innovation with appropriate risk management.

By entrusting cryptocurrency management to authorized financial institutions, Umalis Group addresses one of the primary concerns associated with corporate cryptocurrency adoption – security and regulatory compliance.

Dual Strategic Objectives: Creating Value for Consultants and Company

Consultants benefit from 50% of Bitcoin capital gains under Umalis Group’s strategy

Redistribution of Capital Gains to Consultants

The first strategic objective involves redistributing 50% of the Bitcoin capital gains to salaried consultants. This approach creates a value-sharing framework that aligns incentives between the company and its workforce. By directly connecting company performance with consultant benefits, Umalis Group fosters a culture of shared success and mutual growth.

This redistribution mechanism will be calculated at the end of each annual accounting period, providing consultants with a potential additional income stream beyond their regular compensation. This innovative approach to employee benefits represents a forward-thinking alternative to traditional bonus structures.

Strategic Bitcoin reserve strengthens financial guarantees for consultants

Creation of Strategic Value Reserve

The second objective focuses on creating a strategic reserve of value intended to strengthen the financial guarantees offered to salaried consultants. This reserve will serve as an additional layer of financial security, reinforcing the Group’s financial and social solidity in the face of economic uncertainties.

By establishing this reserve, Umalis Group enhances its ability to fulfill its financial obligations to consultants even during challenging economic periods. This approach demonstrates the company’s commitment to consultant welfare and long-term financial stability.

Discover How Umalis Group’s Bitcoin Strategy Benefits Consultants

Learn more about how our innovative approach to financial management creates value for our consultant community while strengthening our service guarantees.

Executive Perspective: A Vision for Modern Wage Portage

Christian PERSON, Founder and Chief Executive Officer of Umalis Group

« This strategy reflects our vision of a modern, secure wage portage model, leveraging digital assets as tools for hedging and sustainable value creation for the benefit of our salaried consultants. »

Under the leadership of Christian PERSON, Umalis Group has consistently pursued innovation in the wage portage sector. The Bitcoin allocation strategy represents the latest evolution in this journey, combining traditional financial management with emerging digital asset opportunities.

This vision positions wage portage not merely as an administrative service but as a comprehensive financial ecosystem that actively works to create additional value for consultants. By embracing digital assets as tools for hedging and sustainable value creation, Umalis Group demonstrates a forward-thinking approach to financial management in the wage portage industry.

Regulatory Compliance: Transparency and Governance

Umalis Group’s three-pillar governance framework for Bitcoin allocation implementation

Umalis Group emphasizes that the implementation of its Bitcoin allocation strategy will adhere to the highest standards of corporate governance and regulatory compliance. The company has established a comprehensive framework built on three key pillars:

Dedicated Governance

A specialized governance structure will oversee all aspects of the Bitcoin allocation strategy, ensuring responsible management and appropriate risk controls. This dedicated oversight will provide regular evaluation of the strategy’s performance and compliance with regulatory requirements.

Enhanced Financial Monitoring

Umalis Group will implement rigorous financial monitoring processes specifically designed for cryptocurrency assets. This enhanced oversight will track performance, manage volatility exposure, and ensure the strategy remains aligned with the company’s overall financial objectives.

Ongoing Market Disclosure

As a publicly listed company, Umalis Group commits to transparent and regular market disclosure regarding its Bitcoin allocation strategy. This commitment to transparency will keep investors and stakeholders fully informed about the strategy’s implementation and performance.

This comprehensive approach to governance and compliance demonstrates Umalis Group’s commitment to responsible innovation. By operating within a clearly defined regulatory framework, the company ensures that its Bitcoin allocation strategy enhances rather than compromises its fiduciary responsibilities.

Risk Factors: Transparent Cryptocurrency Disclosure

Key risk factors associated with Umalis Group’s Bitcoin payroll allocation strategy

Cryptocurrency Risk Disclosure: Crypto-assets, and Bitcoin in particular, are high-risk financial instruments due to their significant price volatility, the absence of any guarantee of value, potential cybersecurity risks, and possible changes in the regulatory and tax framework in France, the European Union and internationally.

Umalis Group acknowledges and transparently communicates the inherent risks associated with cryptocurrency investments. The company emphasizes that the value of investments in crypto-assets may fluctuate significantly upward or downward and may result in a partial or total loss of the amounts invested. Past performance is not indicative of future performance.

The company clarifies that its Bitcoin allocation strategy does not constitute an offer of securities to the public nor investment advice. Rather, it forms part of Umalis Group’s internal financial management policy, adopted by its governing bodies and implemented in partnership with duly regulated financial institutions.

This transparent approach to risk disclosure demonstrates Umalis Group’s commitment to responsible financial management and stakeholder education. By clearly communicating the potential risks, the company ensures that all stakeholders can make informed assessments based on complete information.

Understand Umalis Group’s Risk Management Approach

Learn more about how we balance innovation with responsible risk management in our Bitcoin allocation strategy.

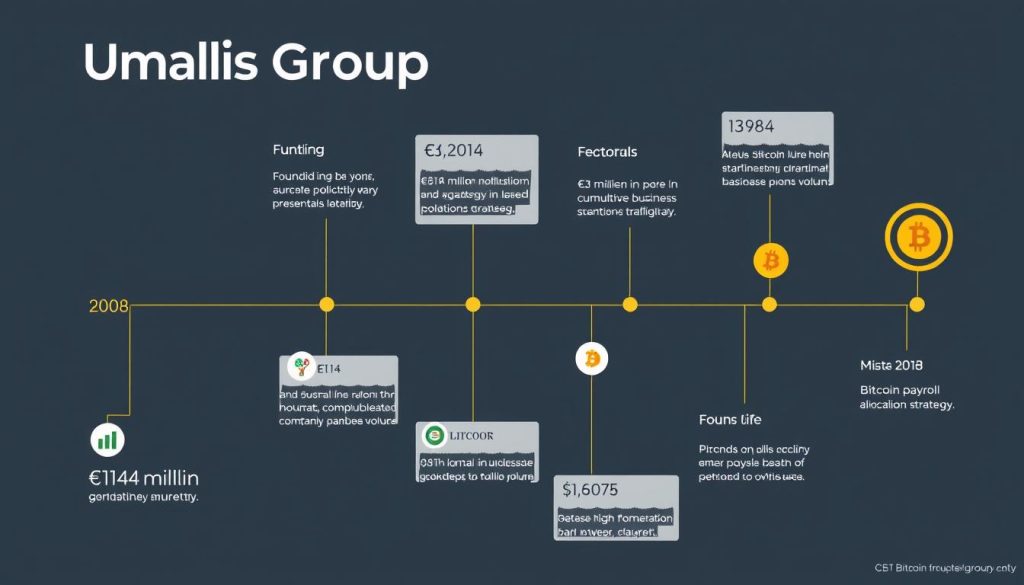

Umalis Group: A Legacy of Innovation in Wage Portage

Umalis Group’s journey from founding in 2008 to pioneering Bitcoin payroll allocation

Since its founding in 2008, Umalis Group has established itself as a leading innovator in the French wage portage market. As the only listed company in this sector, the Group has supported thousands of consultants for over 15 years, primarily in engineering and digital professions, with a cumulative business volume exceeding €140 million.

The company’s growth trajectory reflects its commitment to excellence and innovation in wage portage services. By consistently evolving its service offerings and financial approaches, Umalis Group has maintained its competitive edge in a dynamic market environment.

The Bitcoin allocation strategy represents the latest chapter in Umalis Group’s history of innovation. This initiative builds upon the company’s established foundation while exploring new opportunities to create value for consultants and strengthen financial guarantees.

| Milestone | Year | Achievement |

| Company Founding | 2008 | Establishment of Umalis Group in the French wage portage market |

| Public Listing | 2014 | Became the only publicly listed wage portage company in France (Euronext Access) |

| Business Volume | 2023 | Exceeded €140 million in cumulative business volume |

| Bitcoin Strategy | 2025 | Announced innovative Bitcoin payroll allocation strategy |

Tangible Benefits for Consultants: Beyond Traditional Wage Portage

Consultants gain additional financial benefits through Umalis Group’s innovative strategy

Umalis Group’s Bitcoin allocation strategy offers several tangible benefits for consultants beyond traditional wage portage arrangements. These advantages demonstrate the company’s commitment to creating additional value for its workforce while enhancing financial security.

Key Benefits for Consultants

- Participation in 50% of Bitcoin capital gains, creating potential additional income

- Enhanced financial security through strengthened company guarantees

- Access to cryptocurrency benefits without personal investment or technical knowledge

- Alignment of consultant success with company performance

- Participation in financial innovation within a regulated, secure framework

Considerations for Consultants

- Capital gains are subject to Bitcoin’s market performance and volatility

- Potential regulatory changes may impact the program’s structure

- Benefits are calculated annually rather than immediately available

- Limited to 3% of payroll allocation, moderating potential upside

By offering these benefits, Umalis Group enhances its value proposition for consultants while maintaining a responsible approach to cryptocurrency integration. This balanced strategy creates opportunities for consultants to benefit from digital asset innovation without assuming direct cryptocurrency investment risks.

Pioneering the Future of Wage Portage: Umalis Group’s Vision

Umalis Group’s innovative approach shapes the future of wage portage services

Umalis Group’s Bitcoin payroll allocation strategy represents a significant innovation in the wage portage industry, combining traditional employment benefits with cutting-edge financial approaches. By allocating 3% of its monthly payroll to Bitcoin, the company creates new opportunities for value creation while maintaining a responsible approach to risk management.

This initiative reflects Umalis Group’s broader vision of a modern, secure wage portage model that leverages digital assets as tools for hedging and sustainable value creation. As the only publicly listed company in the French wage portage sector, Umalis Group continues to demonstrate leadership through innovation while maintaining its commitment to consultant welfare and financial security.

The implementation of this strategy, subject to dedicated governance, enhanced financial monitoring, and ongoing market disclosure, sets a new standard for financial innovation in the wage portage industry. As digital assets continue to evolve within the global financial landscape, Umalis Group’s pioneering approach positions the company at the forefront of this transformation.

Discover Umalis Group’s Innovative Approach to Wage Portage

Learn more about how our Bitcoin allocation strategy and other innovative services can benefit your consulting career or business.

For more information about this announcement, visit the official press release on Euronext.

Frequently Asked Questions About Umalis Group’s Bitcoin Allocation Strategy

When will Umalis Group implement the Bitcoin allocation strategy?

Umalis Group has announced the upcoming implementation of this strategic financial scheme. The exact timeline for implementation will be communicated to consultants and the market in accordance with the company’s disclosure obligations as a publicly listed entity.

How will consultants receive their share of Bitcoin capital gains?

Consultants will receive 50% of the Bitcoin capital gains, calculated at the end of each annual accounting period. The specific distribution mechanism will be detailed as part of the dedicated governance framework established for this initiative.

What security measures are in place for the Bitcoin wallet?

The Bitcoin wallet will be operated by a banking institution that holds all necessary authorizations from France’s key financial regulatory bodies, including the AMF and ACPR. This ensures that the cryptocurrency assets are managed within a strictly regulated and secure framework.

Does this strategy expose consultants to cryptocurrency investment risks?

Consultants benefit from potential upside without direct exposure to cryptocurrency investment risks. The strategy is implemented at the company level, with Umalis Group assuming the direct investment responsibility. Consultants participate in potential gains without personally investing in cryptocurrency.

How does this strategy enhance financial guarantees for consultants?

Part of the Bitcoin allocation will create a strategic reserve of value intended to strengthen the financial guarantees offered to salaried consultants. This reserve enhances Umalis Group’s financial and social solidity, providing an additional layer of security for consultant compensation and benefits.