Welcome to your friendly guide on competitive research! Understanding your position in the marketplace is crucial for any company’s growth. This process helps you make smart decisions for long-term success.

Modern tools and AI technology have made competitive research easier than ever. According to HubSpot’s 2024 State of Marketing report, 33% of marketers say AI is their top helper for research. This means businesses of all sizes can now compete effectively.

This approach isn’t about copying others or cutting prices. It’s about learning from the landscape to find unique opportunities for your business to thrive. We’ll walk through practical steps and real examples you can use right away.

Whether you’re starting fresh or improving your current plan, understanding other players is key in today’s fast-moving environment. The time you invest pays off by removing guesswork and building a stronger strategy.

Our step-by-step method makes the process manageable. You’ll learn how to turn market insights into a powerful way to drive growth and success.

Table of Contents

Key Takeaways

- Competitive research helps you understand your market position

- Modern tools and AI make the process accessible for all businesses

- The goal is to find unique opportunities, not copy others

- Practical steps and examples make the process easy to follow

- Investing time in research pays off with better strategic decisions

- Understanding market dynamics is crucial for long-term success

Understanding Competitor Analysis and Market Success

Many thriving businesses share a common secret: they deeply understand their market position relative to others. This systematic approach helps companies make smarter decisions and spot unique opportunities for growth.

What is Competitor Analysis?

Competitor analysis involves systematically evaluating other players in your industry. It goes beyond surface observations to examine business models, strategies, and customer approaches. This deep dive reveals what makes others successful and where they might be falling short.

The process isn’t a one-time checklist but an ongoing practice. Regular evaluation helps your business stay current with market shifts and emerging trends. You’ll gain essential information about your industry landscape.

This research method lets you learn from both successes and mistakes in your market. You gain strategic advantages without trial and error. It’s one of the most cost-effective ways to improve your business strategy.

Understanding the competitive landscape helps identify gaps your company can fill. This positions your business for sustainable growth. For more detailed guidance, explore our resource on effective competitive research.

The Importance of Conducting a Competitor Analysis

When you truly grasp what others in your field are doing, new possibilities emerge. This understanding helps your company stay current with industry standards and customer expectations. It’s about building a stronger position in the marketplace.

Benefits for Business Growth

A thorough competitive analysis reveals where you can excel. You’ll discover untapped niche markets that others have overlooked. This gives your business a chance to capture new customer segments.

Understanding the landscape helps you differentiate your offerings. You can solve customer problems more effectively than other companies. This creates a distinct advantage in your industry.

Regular evaluation lets you measure growth against realistic benchmarks. For example, businesses that conduct this research adapt better to market changes. They maintain their competitive edge over time.

This process provides valuable insight into what customers truly need. It helps you identify your unique value proposition. You can then communicate it clearly to potential clients.

Identifying Direct and Indirect Competitors

Let’s explore the different types of competitors you’ll encounter in your market. Proper categorization helps you understand who you’re really competing against.

« The most dangerous competitors are often the ones you haven’t identified yet. »

Finding Direct Competitors

Direct competitors offer similar products to your same audience. They’re the most obvious players in your space.

Start by searching Google for your main product categories. The companies appearing in top results are likely your direct competitors. Also check who customers compare you to most often.

Discovering Indirect Competitors

Indirect competitors solve the same customer problems but with different approaches. They might serve different segments or use alternative solutions.

Look beyond your immediate industry. For example, Arcade and Storylane are direct competitors in demo automation. Meanwhile, Scribe and Whatfix are indirect competitors offering different documentation solutions.

| Competitor Type | Definition | Identification Method |

|---|---|---|

| Direct Competitors | Same product, same audience | Google search results, customer comparisons |

| Indirect Competitors | Same problem, different solution | Alternative solution research, cross-industry look |

| Legacy Competitors | Established industry leaders | Industry reports, market share data |

| Emerging Competitors | New innovative players | Startup databases, industry news |

Use social media and review sites to find both direct and indirect players. Search relevant hashtags and customer discussions. This competitive research guide offers more detailed methods.

Creating a simple categorization system helps track threats and opportunities. This gives you a complete market picture for better strategic decisions.

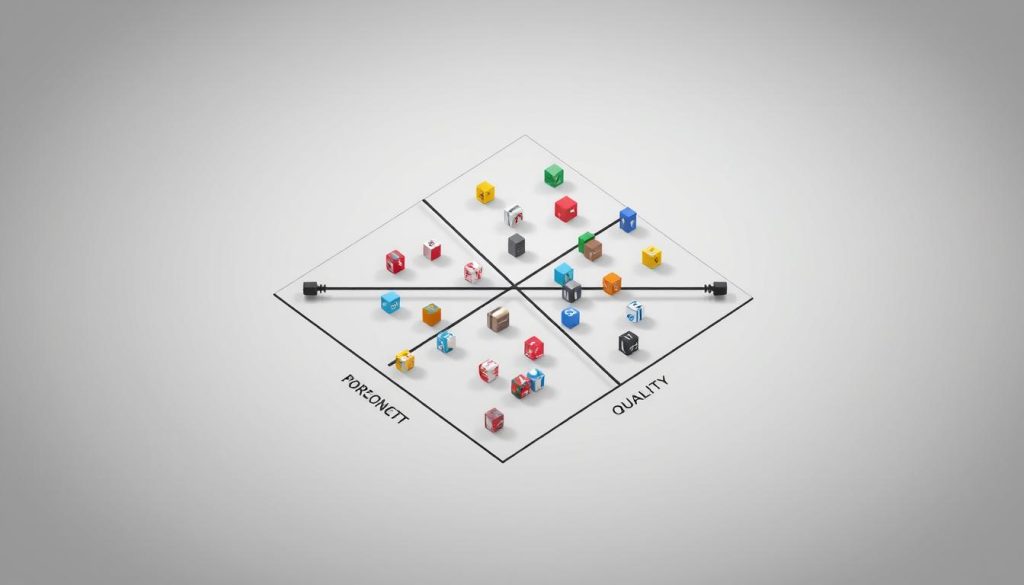

Assessing Competitors’ Market Positions

Understanding market positioning through visual tools transforms complex data into actionable intelligence. This approach helps you see the bigger picture clearly.

Mapping Competitors in the Market

Market mapping creates a visual snapshot of where companies stand. You plot businesses on a grid with two key axes.

The vertical axis shows market presence (share and visibility). The horizontal axis measures customer satisfaction. This simple grid reveals four distinct quadrants.

Leaders dominate with high market share and happy customers. Niche players focus on specific segments with excellent service. Contenders have good visibility but need to improve customer experience. High performers deliver great value but need broader recognition.

This visual approach makes complex market dynamics easy to understand. You can quickly spot opportunities and threats. For deeper insights, explore our competitive research guide.

Consider share of voice as another important metric. It measures how much attention your brand captures compared to others. This helps gauge your company’s visibility and authority.

Regular updates to your market map keep your strategy current. As customer preferences evolve and new players enter, your understanding of the landscape must adapt. This ongoing process ensures you stay ahead of market shifts.

Benchmarking Strengths, Weaknesses, and Opportunities

Effective benchmarking illuminates both opportunities and threats in your competitive landscape. This process involves systematically comparing your business against others across multiple dimensions.

You’ll identify where other companies excel and where they fall short in serving customers. This gives you a clear picture of the market.

Evaluating Strengths

Start by examining what makes other businesses successful. Look at product quality, customer reviews, and market reputation. What are they doing exceptionally well?

Strong companies often have excellent customer retention strategies. They might offer unique features or superior service. These are their key strengths.

Identifying Weaknesses

Now focus on areas where businesses consistently underperform. Analyze customer complaints and negative feedback. Look for service gaps and delivery issues.

Common weaknesses include slow response times or limited product features. These pain points represent opportunities for your business.

| Benchmarking Area | Strength Indicators | Weakness Indicators |

|---|---|---|

| Product Quality | High ratings, positive reviews | Frequent complaints, returns |

| Customer Service | Quick responses, knowledge base | Long wait times, poor support |

| Brand Reputation | Strong recognition, trust | Negative press, low awareness |

| Pricing Strategy | Good value perception | Customer price complaints |

This analysis helps you understand the competitive landscape. Use this information to position your business effectively.

Investing time in thorough research pays off with better strategic decisions. You’ll discover concrete areas for improvement and growth.

Deep Dive into Competitive Product and Service Analysis

Let’s get up close and personal with what other businesses are offering. This deep dive helps you see exactly how your own products and services stack up.

A thorough competitive analysis involves a detailed look at every aspect of what others provide. It’s like being a detective, gathering clues about the market.

Feature Comparison

Creating a feature comparison matrix is your first step. List your product alongside others in a simple table. Focus on key elements customers care about most.

Important features to compare include cost, ease of use, and design aesthetics. Don’t forget warranty coverage and customer support options. This side-by-side view reveals clear differences.

Prioritize features that influence buying decisions. A detailed review shows where your product excels and where others might have an edge.

Service Offerings Evaluation

Next, evaluate the service experience. Look at delivery methods, support channels, and response times. The quality of customer experience matters greatly.

Pricing analysis should go beyond simple numbers. Understand the value proposition at different price points. How do customers perceive that value?

Consider purchasing rival products or services yourself. This firsthand research gives you the customer’s perspective. You’ll experience the journey they take.

Document your findings clearly to spot gaps in the market. Your products and services can then fill these needs more effectively.

Evaluating Competitors’ Marketing Strategies

Digital channels offer a window into how companies build their brand presence. By examining their marketing approaches, you gain insights into what resonates with your shared audience.

This evaluation helps you understand how businesses attract and convert customers. You’ll discover effective tactics for your own campaigns.

Website and Digital Channels

Start by analyzing competitor websites. Look at their structure, messaging, and user experience. Pay attention to their brand voice and calls-to-action.

Tools like Ahrefs and SEMrush reveal valuable SEO data. You can see which keywords they target and their backlink profiles.

| Marketing Channel | What to Analyze | Key Metrics | Tools to Use |

|---|---|---|---|

| Website | Structure, content, UX | Traffic, engagement | SEMrush, Google Analytics |

| Social Media | Content types, frequency | Engagement rates | Social listening tools |

| Email Marketing | Cadence, content style | Open rates, CTR | Email tracking |

| Paid Advertising | Ad copy, targeting | Conversion rates | Ad monitoring tools |

| Content Marketing | Topics, formats | Shares, comments | Content analysis tools |

Social Media and Content Tactics

Examine which platforms your competitors use most actively. Note what content types generate the highest engagement. Look at posting frequency and audience response.

Subscribe to their email lists and follow their content. This reveals their content marketing strategies. You’ll see how they position their brand.

For comprehensive guidance on this process, explore our competitive research resource. It provides detailed methods for effective marketing evaluation.

Utilizing « competitor analysis » for Strategic Advantage

The real power of competitive intelligence lies not in the data collected, but in how you apply it strategically. Many businesses gather information without turning it into meaningful action. This approach misses the core purpose of competitive analysis.

Your competitive analysis should directly inform your business strategy. Look for opportunities to differentiate your offerings and improve customer experience. The goal is finding your unique way to deliver value.

Avoid the trap of copying everything successful companies do. Instead, focus on what aligns with your company’s strengths and vision. This selective approach creates more sustainable advantages.

When reviewing findings, prioritize opportunities that are both feasible and likely to create meaningful impact. Not every gap in the market represents a good opportunity for your specific business.

Remember that strategic advantage comes from thoughtful implementation. Use competitive intelligence to solve problems and enhance your company’s strategic plan. The most powerful insights often reveal what others aren’t doing well.

Keep your own value proposition at the center of decision-making. This ensures your competitive analysis strengthens rather than distracts from your core business strategy.

Leveraging Data and Research for Business Strategy

Turning raw information into actionable insights is the cornerstone of effective business strategy. Quality research helps your company make informed decisions that drive growth.

Analyzing Competitive Data

Effective research combines primary and secondary methods. Primary research gathers new data directly from sources. This includes customer interviews and product testing.

Secondary research uses existing information like industry reports. Both approaches provide valuable insights for your strategy.

| Research Type | Data Sources | Key Benefits |

|---|---|---|

| Primary Research | Customer surveys, focus groups | Fresh, specific insights |

| Secondary Research | Market reports, company records | Time-efficient, broad context |

Investing adequate time in this step is crucial. Thorough data collection leads to better strategic decisions.

Organize your findings systematically. Use spreadsheets or templates to identify patterns. This helps turn raw data into clear business intelligence.

Combining qualitative and quantitative information creates a complete picture. This comprehensive approach strengthens your company’s strategic planning.

Developing a Comprehensive SWOT Analysis

Organizing your findings into a simple four-quadrant grid can transform complex data into strategic clarity. The SWOT framework helps you synthesize all your market research into actionable insights.

This powerful tool examines four key areas. It gives you a complete picture of your market position.

SWOT Matrix Development

The first quadrant focuses on strengths. These are what other businesses do exceptionally well. Look for proprietary technology or strong brand recognition.

Next, examine weaknesses in the market. These are areas where players fall short. Poor customer service or outdated processes are common examples.

Opportunities represent potential growth areas. These could be new market niches or emerging technologies. They show where you can expand your reach.

The final quadrant covers threats. These are external factors that could impact success. New regulations or economic shifts fall into this category.

Create a separate matrix for each major player. This allows you to compare your business directly against the competition. The side-by-side view reveals clear advantages.

Regular updates ensure your strategic planning stays current. As market conditions change, so should your SWOT analysis.

Monitoring Competitors with Effective Tools

Staying updated on industry movements helps you anticipate changes and adapt your approach accordingly. The right monitoring system provides valuable insights without overwhelming your team. It’s about finding the perfect balance between awareness and efficiency.

Choosing Monitoring Tools

Selecting the right tools saves time and delivers better results. Platforms like Ahrefs and SEMrush offer comprehensive website analysis. They track keyword strategies and backlink profiles.

Consider your specific needs before investing. Some tools focus on social media listening. Others specialize in email tracking or website change detection.

Many services offer free trials. Test different options to find what works best for your company.

Regular Analysis Techniques

Establishing a consistent schedule is a crucial step. Quarterly reviews work well for most businesses. Annual deep dives provide broader perspective.

Create a simple tracking system. Document key metrics each time you analyze. This helps spot trends over time.

Set up Google Alerts for important keywords. Follow industry leaders on social media. Subscribe to relevant newsletters.

Regular monitoring keeps your strategy current. It helps you respond quickly to market shifts.

Optimizing Marketing and Customer Engagement

Now let’s explore how to turn your competitive research into powerful marketing improvements. This process helps you connect more effectively with your target audience.

Your marketing strategy should directly address gaps you’ve identified in the market. Look for ways to create smoother customer experiences than others offer.

Refining Customer Engagement Strategies

Study how people interact with other companies’ social media content. Notice which posts generate the most comments and shares. Then create even better material that addresses overlooked customer needs.

Your pricing strategy should reflect the value you provide while remaining attractive. Consider tiered options that meet different customer budgets. This approach can help you reach a wider audience.

« The best marketing doesn’t feel like marketing—it feels like help. »

Monitor review sites and forums where your audience discusses their experiences. This reveals what customers truly value and what frustrates them. Use these insights to improve your service offerings.

Your brand identity should clearly differentiate you from others in your space. Develop messaging that resonates more deeply with your target customers. Focus on solving their specific pain points.

Remember that optimization is an ongoing process. Regularly review how others evolve their sales and marketing approaches. Continuously refine your strategies to maintain your advantage.

Conclusion

Your journey toward market leadership begins with understanding the competitive landscape. Regular competitor analysis transforms how you approach business decisions and growth opportunities.

This practice eliminates guesswork by providing concrete data about what works in your industry. You’ll discover what customers truly value and where gaps exist for your business to fill.

Remember to conduct your competitive analysis regularly—quarterly or annually works well. The market constantly evolves as companies adjust strategies and new players emerge.

The goal isn’t to copy others but to learn from the competition. Identify your unique strengths and develop strategies that position your business to lead.

Start with the steps that feel most manageable for your current situation. The time invested pays off through better strategic decisions and stronger market positioning.

You now have the frameworks and techniques needed to drive your business toward greater success. Understanding your competitors ensures you stay ahead in today’s dynamic business environment.

FAQ

What is a competitor analysis?

It’s a process where you identify other businesses in your market and research their products, pricing, and marketing efforts. This helps you understand your own position and find opportunities for growth.

Why is it important to know your competitors?

Knowing your rivals allows you to spot market gaps, improve your offerings, and make smarter strategic decisions. It helps you anticipate market shifts and better meet customer needs.

How do I find both direct and indirect competitors?

Direct competitors sell similar products to the same audience. You can find them through online searches and customer feedback. Indirect competitors solve the same customer problem with different solutions, often discovered through broader market research.

What should I look for when evaluating a competitor’s strengths?

Focus on their brand reputation, unique product features, customer service quality, and market share. Understanding what they do well can reveal areas where you can differentiate your business.

How can I analyze a competitor’s online presence?

Review their website for user experience and content quality. Check their social media activity, engagement levels, and content strategies. This gives insight into how they attract and interact with their audience.

What tools can help with ongoing competitor monitoring?

Tools like SEMrush, Ahrefs, and Google Alerts can track website traffic, keyword rankings, and online mentions. Regular monitoring helps you stay updated on their latest moves.

How does competitor research improve customer engagement?

By seeing how others interact with customers, you can adopt best practices and create more effective communication strategies. This leads to stronger relationships and higher loyalty.

What is a SWOT analysis in this context?

A SWOT analysis organizes information into Strengths, Weaknesses, Opportunities, and Threats. It provides a clear picture of where you stand relative to others in your industry.