As an independent professional, navigating the world of employee benefits can be daunting. Traditionally, these benefits are offered by employers to attract and retain top talent, but as a self-employed individual, you’re left to create your own safety net.

Many independent professionals in France face unique challenges when it comes to accessing the health insurance and other benefits that their employed counterparts take for granted. However, understanding the available options is the first step towards creating a comprehensive benefits package tailored to your needs.

Employers may offer various types of employee benefits, but as an independent professional, you can curate your own package. This guide will explore the different types of benefits you should consider, from health insurance to retirement planning and beyond.

Table of Contents

Key Takeaways

- Understand the types of employee benefits available to independent professionals.

- Learn how to create a personalized benefits package.

- Discover the importance of health insurance for self-employed individuals.

- Explore retirement planning options for independent professionals.

- Gain a clear roadmap for designing and managing your benefits package.

The Value of Employee Benefits for Independent Professionals

For independent professionals, employee benefits are not just a perk; they are a vital component of their career sustainability and financial security. In the United States, many employers are not required to provide certain benefits, leaving independent professionals to navigate this complex landscape on their own.

Definition and Purpose of Employee Benefits

Employee benefits encompass a range of programs and services designed to support the well-being and financial security of employees. These benefits can include health insurance, retirement plans, and other forms of support. For independent professionals, these benefits are crucial as they provide a safety net in the absence of employer-provided coverage.

Why Benefits Matter for Career Sustainability

Career sustainability for independent professionals heavily relies on their ability to manage risks and maintain their well-being. Employee benefits play a critical role in this by providing access to necessary services like health insurance and retirement planning. This not only ensures their current well-being but also their future financial security.

The Unique Challenges for Independent Professionals

Independent professionals face significant hurdles in accessing benefits, including higher individual insurance costs and the lack of group rates. They must also manage their retirement plans without employer support. Some of the challenges they face include:

- Managing the financial burden of self-providing all benefits.

- Navigating administrative complexity in benefits management.

- Dealing with inconsistent income patterns that affect benefit contributions.

Types of Employee Benefits

Employee benefits play a significant role in enhancing the quality of life and work satisfaction for professionals. As the modern workforce evolves, understanding the different categories of benefits becomes crucial for both employers and independent professionals.

Required vs. Optional Benefits

Employee benefits can be broadly categorized into required and optional benefits. Required benefits are those mandated by law, such as social security contributions and certain insurance coverages. Optional benefits, on the other hand, are provided at the discretion of the employer or can be arranged by independent professionals themselves. These may include fringe benefits, which are additional perks that enhance job satisfaction and overall wellbeing.

Industry Standard Benefits

Industry standard benefits typically include health insurance, retirement plans, and paid time off. For independent professionals, replicating these benefits requires careful planning and budgeting. For instance, they might invest in private health insurance or create their own retirement savings plans. Understanding industry standards can help independent professionals identify areas where they can create equivalent benefits for themselves, such as through strategic financial planning.

Fringe Benefits and Perks

Fringe benefits represent additional compensation beyond salary that can significantly enhance an independent professional’s work experience. Common examples include professional development stipends, flexible work arrangements, technology allowances, and wellness programs. For independent professionals, creating these benefits requires deliberate planning but can lead to improved productivity and work satisfaction. Some of these benefits, such as certain fringe benefits, may also offer tax advantages, making them financially efficient. By incorporating such benefits into their business model, independent professionals can avoid burnout, maintain competitive skills, and create sustainable work patterns, ultimately enhancing their overall quality of life.

Health and Wellness Benefits

Ensuring health and wellness is a critical aspect of managing a successful independent career. As an independent professional, you must navigate various health and wellness challenges without the traditional support structures provided by an employer.

To maintain their overall wellbeing, independent professionals need to prioritize health and wellness benefits. This includes health insurance, dental and vision coverage, and mental health resources.

Health Insurance Options for Self-Employed

Health insurance is a critical component of health and wellness benefits. As a self-employed individual, you can explore various health insurance options, including plans through professional associations, private insurance providers, or government-sponsored marketplaces.

When choosing a health insurance plan, consider factors such as coverage, deductibles, and out-of-pocket costs. Some plans may offer additional benefits, such as employee assistance programs (EAPs), which provide confidential counseling and support services for personal or work-related difficulties.

Dental and Vision Coverage Alternatives

While health insurance is crucial, dental and vision coverage are also essential for overall health. As an independent professional, you can consider alternative dental and vision coverage options, such as discount plans or joining a professional association that offers these benefits.

These alternatives can help reduce out-of-pocket costs for dental and vision care, ensuring you maintain your overall health and wellbeing.

Mental Health Resources and Support

Mental health support is increasingly critical for independent professionals, who often face unique challenges such as isolation and inconsistent income stress. Without employer-provided EAPs, you must proactively create your own mental health support systems.

Digital mental health platforms offer accessible options, including therapy apps, meditation resources, and online counseling services. Additionally, professional communities and peer support groups can provide valuable mental health resources tailored to the challenges of independent work.

To maintain a healthy work-life balance, it’s essential to establish clear boundaries between work and personal life. This allows you to manage stress and maintain your mental wellbeing.

Financial Security and Retirement Planning

Independent professionals must prioritize financial security and retirement planning. Unlike traditional employees, they lack access to employer-provided safety nets such as workers’ compensation. Therefore, creating personal financial buffers against work disruptions is crucial.

Retirement Savings Plans for Independent Workers

Retirement savings plans are essential for independent workers. Options include SEP-IRAs, solo 401(k)s, and traditional IRAs. These plans offer tax advantages that can help maximize retirement savings. For instance, contributions to a SEP-IRA are tax-deductible, reducing taxable income.

It’s essential to choose a plan that aligns with your financial goals and to start saving early to ensure a comfortable retirement.

Life and Disability Insurance Options

Life and disability insurance are critical components of a comprehensive financial plan. Life insurance provides a safety net for dependents, while disability insurance replaces income if you’re unable to work due to illness or injury.

For independent professionals, disability insurance is particularly important as it helps maintain financial stability during periods of incapacity. The Family and Medical Leave Act (FMLA) allows employees to take up to 12 weeks of unpaid leave, but independent professionals must plan differently, as they are not covered under this act.

Building Financial Safety Nets

Building financial safety nets is vital for independent professionals. This includes maintaining an emergency fund to cover 6-12 months of expenses, diversifying income streams, and considering business interruption insurance to mitigate the impact of work disruptions.

Without access to workers’ compensation or paid family leave benefits, independent professionals must proactively plan for potential caregiving responsibilities through dedicated savings and flexible work arrangements.

Creating Your Own Time Off Structure

Independent professionals must proactively create their own time-off structures due to the lack of traditional employer-provided benefits. This involves designing a system that balances work and personal life, ensuring sustainability and financial stability.

Designing a Sustainable PTO System

To create a sustainable PTO system, independent professionals should first assess their annual work schedule and client commitments. This assessment helps in identifying periods that can be allocated for time off. It is essential to communicate PTO plans to clients in advance through contract clauses or regular updates.

Building an emergency fund to cover unexpected absences is also crucial. This fund acts as a buffer, ensuring that income remains stable even during periods of illness or family emergencies.

- Plan your PTO around your client commitments and work schedule.

- Communicate your PTO plans to clients through contracts or regular updates.

- Build an emergency fund to cover unexpected absences.

Planning for Family and Medical Leave

Planning for family and medical leave is another critical aspect of creating a time-off structure. Although independent professionals are not covered by the Family and Medical Leave Act (FMLA), they can devise alternative strategies. One approach is to create a family and medical leave fund to ensure financial stability during such periods.

Insurance products like critical illness coverage can provide a lump-sum benefit, helping to fund periods of family or medical leave. Additionally, having a professional network that can provide referrals or coverage during absences helps maintain client relationships.

| Strategy | Description | Benefit |

|---|---|---|

| Family and Medical Leave Fund | Creating a dedicated fund for family and medical emergencies | Financial stability during leave |

| Critical Illness Coverage | Insurance that provides a lump-sum benefit in case of serious illness | Financial support during health-related leave |

| Professional Network | Building a network for referrals or coverage during absences | Maintained client relationships |

Navigating Employee Benefits in France

Navigating the world of employee benefits as an independent professional in France requires a clear understanding of the available options. The French system is designed to provide a robust framework for various benefits, but it can be complex to navigate.

The French Social Protection System

The French social protection system is renowned for its comprehensive coverage. It includes a basic healthcare system that covers a portion of medical expenses. As an independent professional, understanding this system is crucial. The system provides a foundation, but additional coverage may be necessary to ensure complete financial protection.

Key aspects of the French social protection system include:

- Basic healthcare coverage for all residents

- Additional benefits for specific professions or circumstances

- A framework that integrates various social security benefits

Auto-Entrepreneur and RSI Benefits

As an auto-entrepreneur, you are part of the Régime Social des Indépendants (RSI). The RSI provides a range of benefits, including health insurance, retirement plans, and other social security benefits. Understanding the specifics of these benefits is essential for managing your career effectively.

The RSI benefits may include:

- Health insurance coverage

- Retirement savings plans

- Other social security benefits tailored for independent professionals

Complementary Health Insurance in France

In France, complementary health insurance (mutuelle) plays a vital role in covering medical expenses not included in the basic healthcare system. As an independent professional, you must select and fund your own complementary health insurance. Various plans are available, ranging from basic to comprehensive coverage.

When choosing a complementary health insurance plan, consider:

- The level of coverage needed

- Additional services such as dental and vision care

- Tax incentives that may reduce the cost

As emphasized by the French healthcare system’s structure, « complementary health insurance is not just an add-on, but a necessary component of comprehensive healthcare coverage. » Understanding the interaction between the basic healthcare system and complementary insurance is crucial for optimizing your coverage.

How to Access Employee Benefits as an Independent Professional

The landscape of employee benefits is evolving, with new options becoming available for independent professionals who seek to enhance their career sustainability.

Professional Associations and Cooperatives

Professional associations and cooperatives offer a valuable route for independent professionals to access benefits. These organizations often provide a range of benefits, including health insurance, professional development opportunities, and networking events. By joining such groups, independent professionals can tap into a collective pool of resources and support.

Portable Benefits Platforms

Portable benefits platforms are designed to provide benefits that move with the worker, rather than being tied to a specific employer. These platforms cater to the needs of independent professionals by offering benefits like health insurance, retirement savings plans, and other perks. They provide flexibility and continuity, essential for those with variable incomes or multiple projects.

Umbrella Companies and Alternatives

Umbrella companies provide a structure where independent professionals can access some employment benefits while maintaining work flexibility. They offer a hybrid model that allows professionals to work with their own clients while enjoying benefits like paid time off, pension contributions, and simplified tax administration. Alternative models, including professional employer organizations (PEOs) and employer of record (EOR) services, offer similar benefits with different operational structures.

In conclusion, independent professionals have several options to access employee benefits, each with its unique advantages. By exploring these alternatives, professionals can create a benefits package that suits their needs and enhances their career sustainability.

Building Your Personalized Benefits Package

Independent professionals must take charge of their own benefits, crafting a package that meets their unique needs and priorities. This process involves several key steps to ensure that the benefits package is both effective and sustainable.

Assessing Your Needs and Priorities

The first step in building a personalized benefits package is to assess your needs and priorities. This involves evaluating your financial situation, health needs, and career goals. By understanding what you need, you can create a benefits package that is tailored to your specific circumstances.

Budgeting for Self-Provided Benefits

Budgeting is a critical aspect of creating a self-provided benefits package. You must determine how much you can afford to allocate towards various benefits, such as health insurance, retirement savings, and other forms of protection. Effective budgeting enables you to manage your expenses while ensuring you have the necessary coverage.

| Benefits Category | Annual Budget Allocation | Percentage of Total Income |

|---|---|---|

| Health Insurance | $5,000 | 10% |

| Retirement Savings | $3,000 | 6% |

| Disability Insurance | $1,500 | 3% |

Implementing and Managing Your Benefits

Implementing and managing your benefits package requires ongoing attention. This includes establishing systems for regular contributions, policy management, and administrative oversight. Regular reviews of your coverage adequacy and cost-effectiveness are crucial to ensure that your benefits continue to meet your changing needs.

- Creating a benefits calendar to track important dates

- Centralizing documentation of all benefits policies and account information

- Utilizing technology tools to streamline benefits management

- Consulting with professional advisors for optimized benefits implementation

Managing self-provided employee benefits requires a proactive approach to ensure they remain aligned with your goals and priorities.

Tax Advantages for Independent Professionals

Tax advantages play a pivotal role in enhancing the financial health of independent professionals. Understanding and leveraging these advantages can lead to significant savings and improved financial stability.

As an independent professional, you are entitled to various tax deductions that can reduce your taxable income. This includes deductions related to business expenses, health insurance premiums, and retirement contributions.

Tax-Deductible Benefits in France

In France, independent professionals can benefit from tax-deductible expenses related to their business operations. This includes expenses such as office supplies, travel expenses, and certain types of insurance premiums.

Understanding the specific tax laws and regulations in France is crucial for maximizing your deductions. It is advisable to consult with a tax professional who is familiar with French tax law to ensure you are taking advantage of all eligible deductions.

Strategic Tax Planning for Maximum Advantage

Strategic tax planning is essential for independent professionals to minimize their tax liability and maximize their benefits. This involves selecting the appropriate business structure, categorizing expenses correctly, and optimizing the timing of benefit-related expenditures.

- Strategic tax planning can significantly reduce the net cost of self-provided benefits through appropriate business structure selection and expense categorization.

- Business entity choice (sole proprietorship, LLC, S-corporation) has substantial implications for how benefit expenses are treated for tax purposes.

- Health insurance premiums may be deductible as business expenses for self-employed individuals, potentially providing significant tax savings.

- Retirement contributions often offer immediate tax deductions while also providing long-term tax-advantaged growth.

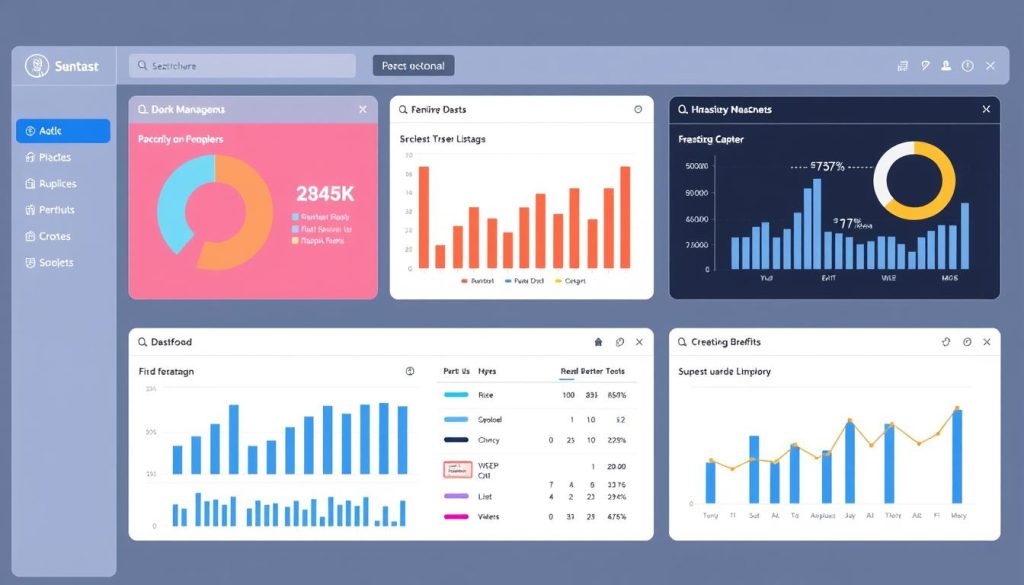

Digital Tools for Benefits Management

The world of employee benefits can be daunting for independent professionals, but digital tools can simplify the process.

Benefits Management Software and Apps

Benefits management software and apps are designed to help independent professionals manage their employee benefits efficiently. These tools offer a range of features, including benefits tracking, compliance management, and personalized benefit recommendations.

Some key features to look for in benefits management software include:

- Customizable benefits packages

- Automated benefits administration

- Real-time benefits tracking

Financial Planning and Tracking Tools

Financial planning and tracking tools help independent professionals manage their employee benefits as part of their overall financial strategy. These tools provide a comprehensive view of one’s financial situation, enabling better decision-making.

Some of the ways financial planning tools can assist include:

- Retirement calculators calibrated for variable income patterns

- Cash flow management to budget for benefits contributions

- Tax planning software to identify potential deductions related to self-provided benefits

- Investment platforms with self-employed retirement options

- Budgeting apps with benefits categories to visualize and manage the true cost of comprehensive coverage

The Future of Employee Benefits for Independent Workers

As the workforce continues to evolve, the future of employee benefits for independent professionals is being reshaped. This transformation is driven by the need for more flexible, portable, and comprehensive benefits that cater to the unique challenges faced by independent workers.

Emerging Benefit Models and Innovations

Emerging benefit models are focusing on portability and flexibility. Portable benefits platforms are being developed to allow benefits to move with the worker across different projects and clients. This innovation is crucial for independent professionals who do not have access to traditional employer-provided benefits. For instance, some platforms offer health insurance options that are not tied to a specific employer.

Policy Changes and Advocacy Efforts

Advocacy efforts are gaining momentum to create a more supportive environment for independent professionals. Policy changes, such as portable benefits legislation, are being proposed to extend benefit protections to non-traditional workers. Industry associations and freelancer unions are working to influence legislation that addresses the unique challenges of independent professionals, including family medical leave and other essential benefits.

The future of employee benefits for independent workers is being shaped by emerging benefit models, policy changes, and advocacy efforts. As the workforce continues to evolve, it is essential for independent professionals to stay informed about these developments to ensure they have access to the benefits they need.

Conclusion

In the ever-evolving landscape of independent work, understanding and accessing the right employee benefits is crucial for maintaining a healthy work-life balance. Independent professionals face unique challenges in accessing traditional employee benefits, but multiple pathways exist to create comprehensive protection.

Creating a personalized benefits package requires careful assessment of individual needs, strategic budgeting, and ongoing management. Health insurance and retirement savings represent the foundation of a solid benefits strategy for most independent professionals.

The French context offers both challenges and opportunities, with important differences from other systems. Digital tools and professional associations are making it increasingly feasible for independent professionals to access comprehensive benefits. As the independent workforce continues to grow, both policy and market innovations are likely to create more supportive environments for self-employed professionals seeking benefits protection.

By understanding the available options and creating a tailored approach, independent professionals can ensure their professional development and financial security.

FAQ

What are the most essential employee benefits for independent professionals to consider?

As an independent professional, it’s crucial to consider health insurance, retirement savings plans, and life insurance to ensure financial security and stability.

How do I access health insurance as a self-employed individual?

You can explore health insurance options through professional associations, cooperatives, or portable benefits platforms, which can provide you with a range of plans and coverage.

What is the Family and Medical Leave Act, and how does it apply to independent professionals?

The Family and Medical Leave Act is a federal law that provides eligible workers with unpaid leave for certain family and medical reasons. While it may not directly apply to independent professionals, you can create your own family and medical leave structure.

How can I plan for retirement as an independent professional?

You can consider retirement savings plans, such as a SEP-IRA or solo 401(k), to build a secure financial future. It’s essential to assess your needs and priorities to create a personalized retirement plan.

What are fringe benefits, and how can they support my career as an independent professional?

Fringe benefits are additional forms of compensation that can enhance your overall benefits package. They may include commuter benefits, professional development opportunities, or other perks that can support your work-life balance and career goals.

How can I manage my benefits effectively as an independent professional?

You can use digital tools, such as benefits management software and apps, to streamline your benefits administration and stay organized. This can help you prioritize your needs and make informed decisions about your benefits.